Popular

Investing in 2024 for Gen Z and Millennials

Snowball Team

What is a W9 form used for?

The W-9 Form is most commonly filled out by taxpayers who work as a freelancer or independent contractor rather than a full-time employee. It helps businesses get important information from independent contractors or freelancers that they hire and make payments to. Since these payments to contractors must be recorded to the IRS, having a contractor fill out a W-9 allows businesses to issue a 1099-MISC Form to the contractor at the end of the year. Whereas the W-9 collects information solely for the client or business, the 1099-MISC Form is what a contractor receives at the end of the year that reports their income to the IRS. Here is the link to download directly from the IRS website: https://www.irs.gov/pub/irs-pdf/fw9.pdf

Common Mistakes

The W-9 Form is relatively straightforward. However, clients should make sure to avoid these common mistakes when issuing the 1099:

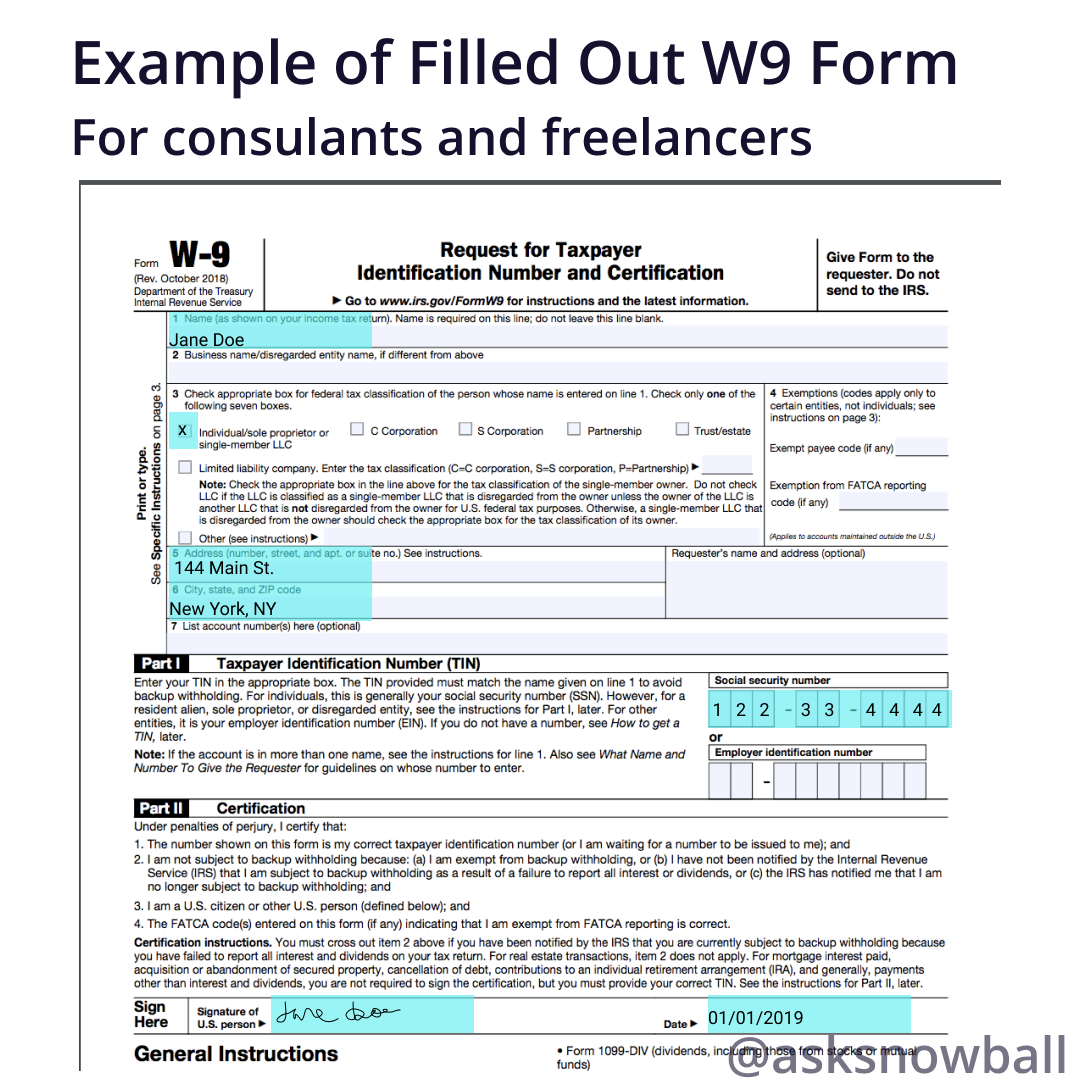

Here is an example of a completed W-9 Form if you are an independent contractor or freelancer:

When do I use a W9?

The best time to get a W9 is when you first start working with your independent contractor to ensure that you will have the information needed to complete the year-end 1099 if you have paid them over the minimum reporting requirement.

Is there a minimum required to report?

Yes, the minimum required to report is $600. If you pay a freelancer or independent contractor under $600 during a tax year then you do not need to fill out a W-9 form. However, if you pay them more than $600 then you are required to report it the following year.

Does the IRS need the W9 Form?

When your contractor provides you a W9, you should keep a copy of it in case you are audited. This shows that you’ve asked for the correct information from the taxpayer. The IRS does not need a copy of this document.

How do I know if I’m subject to backup withholding?

If you have not received a letter from the IRS that states that you are subject to mandatory backup withholding, then you are not subject to any withholding. However, if you have received a letter then you will need to cross out item two in part two of the W9 Form.

What information is required on the form?

The form is relatively straightforward. It requires a name, address, and either a Social Security Number or Employer Identification Number.

I have an Employer Identification Number and a Social Security Number, which one should I provide on the form?

If you are the sole proprietor than either number works but if your business is an LLC, a corporation or a partnership, you should use the entity’s Employer Identification Number. If your business is a single-member LLC then you can use either your own EIN or SSN.

What if I refuse to submit a W9?

If you do not submit a W9 when a business sends a legitimate request, then you are subject to backup withholdings up to 28 percent on your payments. As a reminder, always make sure that each W-9 request is legitimate to avoid scams and identity theft.